tax air freight rules tariff

Tax Guru is a reliable source for latest Income Tax GST Company Law Related Information providing Solution to CA CS CMA Advocate MBA Taxpayers. CBDT has issued a detailed circular no 715 on tds us 194C194I and 194J dated 881995 In which 34 question has been dealt In this circular question number 6 relates to payment made to travel agentairline for booking of tickets It has been clarified in the circular that notwithstanding the payment has been made by the payee list mentioned as above but the.

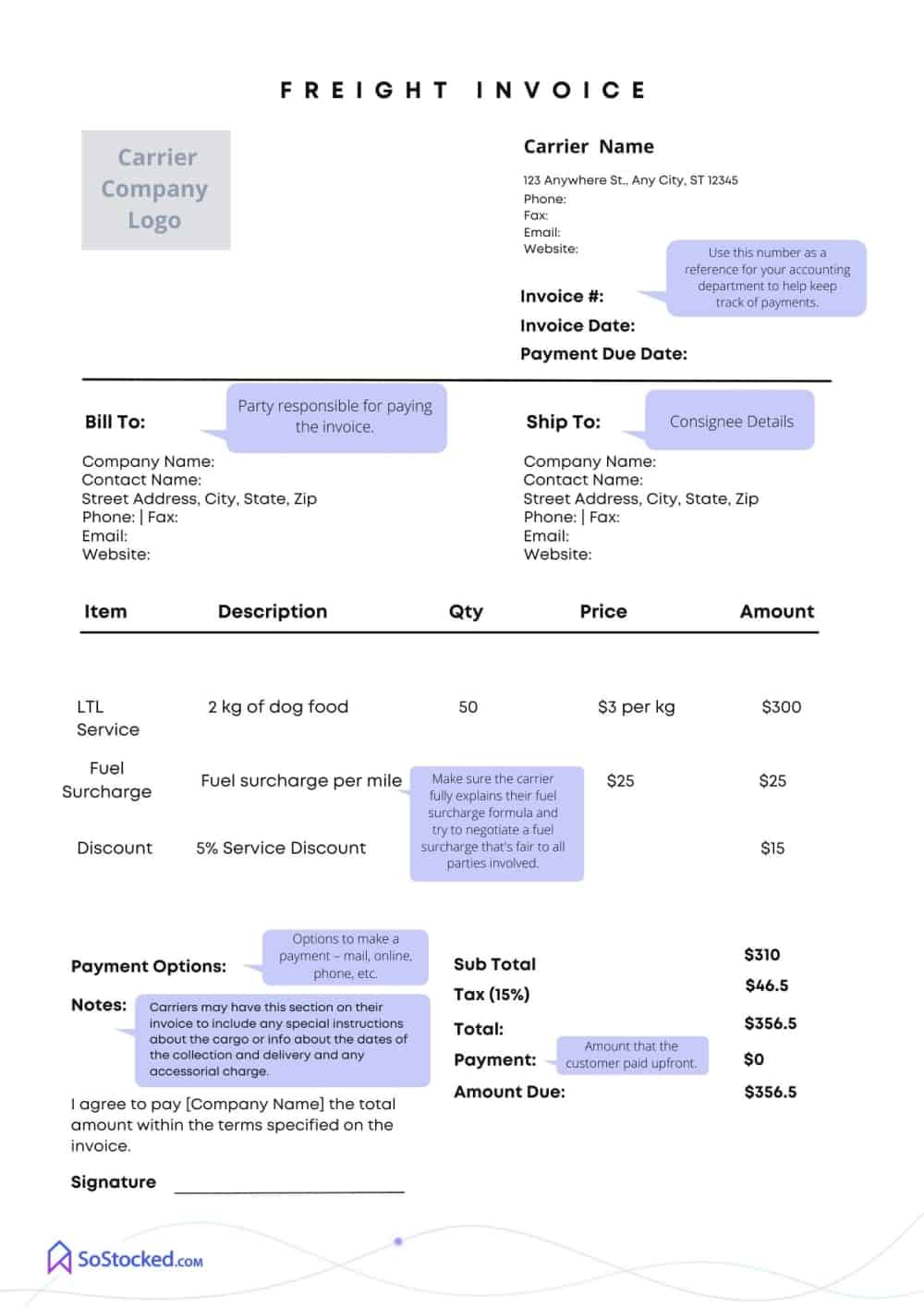

How To Read And Understand Your International Airfreight Bill

Here are our tips to finding a tariff code.

. The present rate is 145 without any form or 2 against form C. The Congress shall evolve a progressive system of. In all other cases from the list in UK Trade Tariff.

The harmonized rules set under the Directive 200396EC of 27 October 2003 restructuring the Community framework for the taxation of energy products and electricity Energy Taxation Directive or ETD aim to ensure the proper functioning of the Internal Market. Central Sales Tax will be charged extra at the time of shipment. A tariff is a concept that encompasses sectoral air cargo rates published by each carrier and related rules.

Constitution grants Congress the sole authority to regulate foreign commerce and therefore impose tariffs but through various trade laws Congress has delegated authority to the president to. So you cannot directly use the result in. Occasionally your supplier will help you out but dont forget to check the tariff code as the global systems are structured in a similar way but the codes arent always identical.

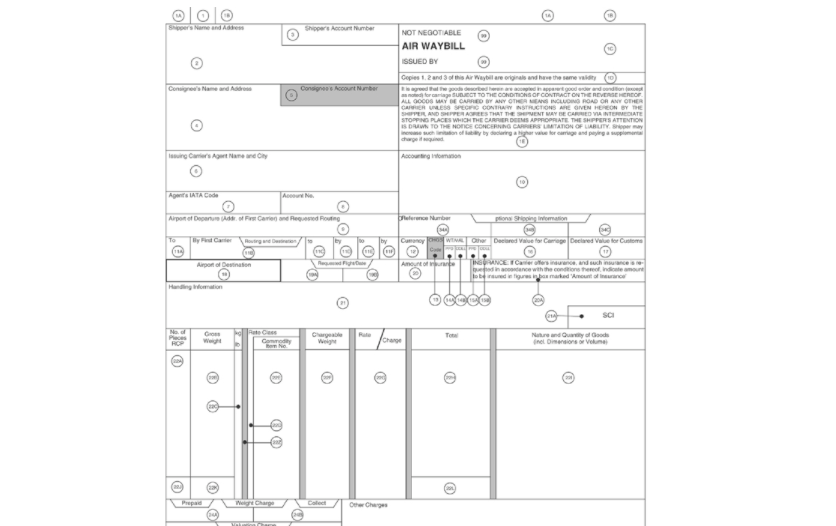

The rate is the amount charged by the carrier for the carriage of a unit of weight and may differ from actual selling ratesThe rate is the amount inserted into the Air Waybill AWB and is the basis for discount. International Trade Commission ITC. The tax is imposed based on the Entry 52 of the State List from the Schedule VII of the Constitution of India which reads.

Freight location codes enter the relevant code for. But the result that you get is in the Text Format. When your goods are valued at 800 or more and shipped by international express it will be convenient for you to pay the import tax because the express agent will pay it for you in.

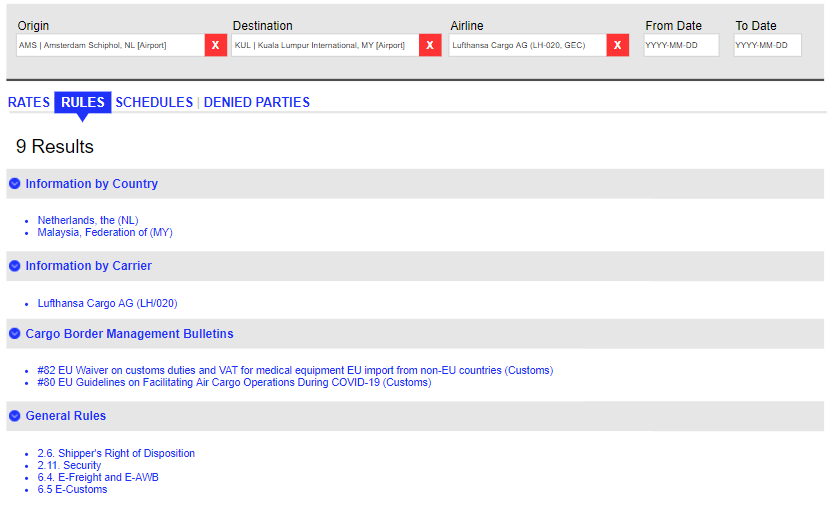

What is an air cargo tariff. Imaginining that in the freight declared at the HAWB has a profit margin for the agent at the destiny. On 13 September 2014 I understand that the freight forwarder at origin Invoices the agent in the destiny to collect the freight.

The 1987 Philippine Constitution sets limitations on the exercise of the power to tax. The employer identification number or other tax identification number of the USPPI. Like the US Canada has addition taxes and fees.

Federal taxes the GST is levied by the Canadian federal government and is typically paid at the time of importation. The Tax Code of 1997 Revenue Issuances and BIR Rulings pertaining to national taxes are posted at the BIR website. Usage of street furniture for installation of small cells and telegraph line 10B.

How to pay tariff is related to shipping methods. Effective July 1 2021 the European Commission has updated some of the rules for VAT e-commerce launching an import one stop shop IOSS for online retailers to declare and pay duties and getting rid of the low-value consignment relief policy that previously exempted packages valued at under 22 from VAT. Similar to state taxes PST is a tax issued by the individual Canadian provinces.

Customs Clearance with a value above a 1000 All goods imported into Australia by sea air or post with a customs value that exceeds 100000 must be cleared by submitting a completed import declaration and paying duty goods and services tax. In order to classify your goods youll need to make use of the Tariff. The INR function converts a number to the Indian Style Comma formatted currency as you can see in the snapshotThe commas are placed in the right places separating lakhs and crores.

Air Freight International Express. And b from so much of integrated tax leviable thereon under sub-section 7 of. Taxes on the entry of goods into a local area for consumption use or sale therein The tax is to be paid by the trader to the civic bodies and the rules and regulations of these vary amongst different States in India.

Exemption to specified goods falling under various Chapters Notificatrion No10107-Cus dt1192007. For more information about the new rules and what. In a routed export where the authorized freight forwarder or other agent is doing the filing the FTR requires the USPPI to provide the following data elements.

The corresponding entry in column 2 of the said Table when imported into India- a from so much of the duty of customs leviable thereon under the said First Schedule as is in excess of the amount calculated at the standard rate specified in the corresponding entry in column 4 of the said Table. Outward seaair freight and marineair. How to Pay the Import Tax.

- Indian Telegraph Right of Way Amendment Rules 2022 - New Rule 10A. Import Duty MPF Informal Entry 2500. The point of origin for the merchandise awaiting.

The name as well as the address of the USPPI. Goods and Services Tax. Using our example of footballs and the current list of US HTS Codes there would be a big difference between reporting your pallet of footballs as 95066240 Inflatable balls footballs and soccer balls which can be imported duty free and reporting it as 95066280 Inflatable balls other for which you would pay a 48 import tax.

Using the Tariff to get a Duty Rating. Value Added Tax Act 1994 - Section 161. Tariff rates may be found in the Harmonized Tariff Schedule HTS maintained by the US.

The rule of taxation shall be uniform and equitable. Rules for determining the origin of products eligible for preferential tariff concession for trade between India and Singapore - Notification No.

Air Freight Forwarding A Definitive Guide 2022 Freightpaul

Freight Rate Calculator Shipping Costs Via Air Sea

How To Read And Understand Your International Airfreight Bill

Freight Forwarder Fees Checklist Protect Your Profits

Air Freight Quotation How To Understand Tiba

Air Freight Forwarding A Definitive Guide 2022 Freightpaul

How To Read And Understand Your International Airfreight Bill

Air Cargo Terms And Abbreviations United Worldwide Logistics

Iata Air Cargo Tariffs And Rules What You Need To Know

Freight Forwarder Fees Checklist Protect Your Profits

Freight Shipping Calculator Estimate Freight Rates Cost Fedex